Harley Davidson Financial Analysis

The company markets its products in North America Europe AsiaPacific and Latin America.

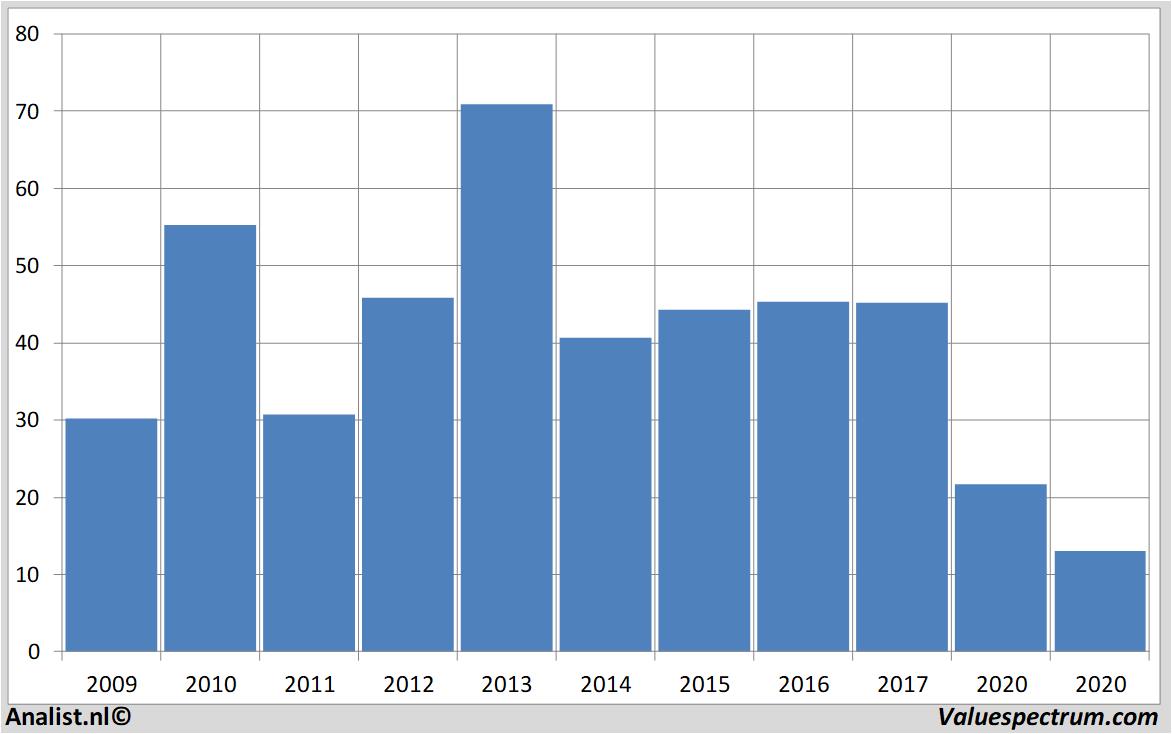

Harley davidson financial analysis. There are five lines of motorcycles manufactured by Harley Davidson which has its. Saneya el GalalyPresented By. According to these financial ratios Harley-Davidson Incs valuation is way above the market valuation of its sector.

This first report focuses on strategy analysis and includes the following sections. I hope you enjoy and feel fr. Harley Davidson Strategic Analysis 1.

The Motorcycles and Related Products segment designs manufactures and sells cruiser and touring motorcycles for the heavyweight market. It is currently a public company with over 100years of experienceproducing motorcycles. The Motorcycles Related Products segment and Financial Services.

Harley-Davidson manufactures heavyweight motorcycles as well as a complete line of parts apparel and accessories for motorcycles. EBTEBIT The companys operating income margin or return on sales ROS is EBIT. The primary business activity of the company is Motorcycles Bicycles and Parts SIC code 3751.

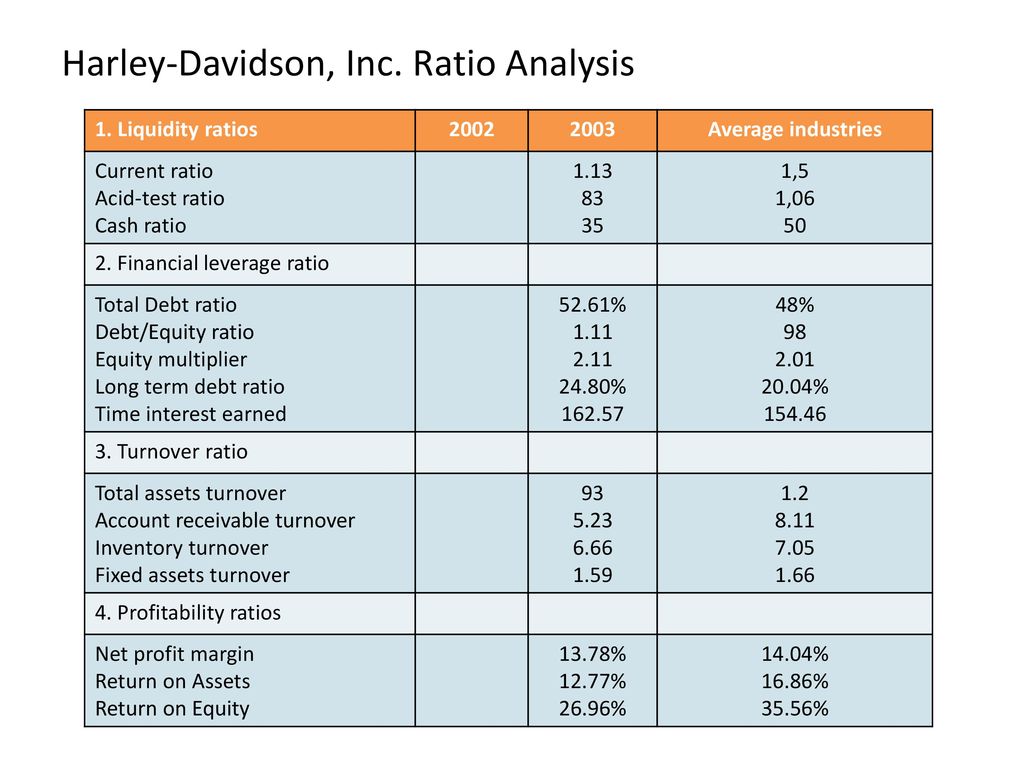

Internal Analysis Financial Analysis Harley-Davidsons financials are a key component on internally analyzing Harley-Davidson and how well they are performing by. This project is for the FA -18 Financial Management Course at Wisconsin Luther College. First we have found that Harley is a highly liquid company.

Harley-Davidson designs manufactures and sells heavyweight motorcycles. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Harley-Davidson Incs. Unit Non-Rating Action Commentary Wed 05 Oct 2005 Fitch Completes Release of Issuer Default Ratings for Automotive Automotive Parts Capital Goods Sectors.